Do you qualify?

Qualifying R&D activity can be undertaken in almost any industry.

However, it is often unclear to businesses whether an activity constitutes qualifying R&D – this is where we can help. We will explain the definition of R&D for tax purposes, how HMRC interpret it, and discuss with you how this relates to your activities.

If you can answer ‘yes’ to any of the following questions then R&D Tax Reliefs may be available to your company:

- You have developed (or attempted to develop) any new products, processes or systems;

- You have made any improvements to existing products, processes or systems;

- You have undertaken any other system, product or process development;

- You encountered uncertainty in attempting to achieve any of the above – i.e. perhaps your technical team knew what you want to achieve but needed to consider and analyse different solution options before arriving at the most suitable answer.

Claim notification

Companies must inform HMRC of their intention to make a claim for R&D tax relief using a new digital form. This requirement will apply for claims to relief for accounting periods starting on or after 1 April 2023. As this measure is intended to allow HMRC to perform more upfront compliance on new claimants, companies which have claimed R&D tax reliefs in the previous three years will be exempted from this requirement.

This is only for businesses that have never claimed R&D relief before 1 April 2023 and those that have not claimed in the last three calendar to April 2023. They must notify HMRC of their intention to claim within six months of the end of the accounting period in which the R&D took place.

Claim deadline

Companies have 2 years from the end of an accounting period in which to make a claim for R&D Tax Reliefs. We are able to prepare claims very quickly, particularly where the 2 year deadline is fast approaching! However, we would highly recommend that you start the substantive claim process at least 6 weeks before the deadline date.

Why claim – the benefit of R&D Tax Reliefs

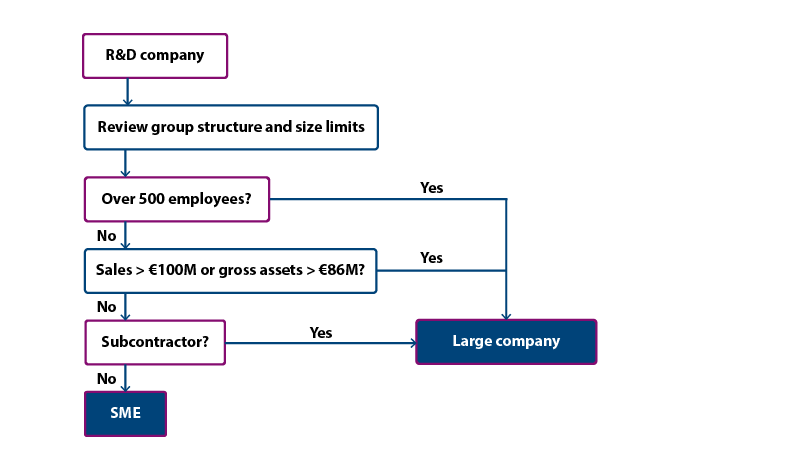

SME v. Large

The cash benefit a company receives from claiming R&D Tax Reliefs depends on whether it qualifies as a Small or medium sized enterprise (‘SME’).

It can be complex to determine whether a company is an SME as the wider group and investors also need to be considered. In particular, the ownership structure of the company must be examined and a proportion of the results of any enterprises which hold 25% or more of the share capital must be added together before the above thresholds are tested. There are exclusions and each case should be examined before the claim is made.

Merging of the RDEC and SME schemes

The government’s consultation on merging the RDEC and SME schemes closed on 13 March 2023. The merged scheme R&D expenditure credit (RDEC) and enhanced R&D intensive support (ERIS) replace the old RDEC and small and medium-sized enterprise (SME) schemes for accounting periods beginning on or after 1 April 2024. The expenditure rules for both are the same, but the calculation is different.

The table below summarises. the potential tax benefit for to be gained under the schemes.

| SME Scheme | RDEC Scheme | Merged Scheme – R&D expenditure credit (RDEC) | Enhanced R&D intensive support (ERIS) for SME’s | |||

| Up to 31/03/2023 | From 01/04/2023 | Up to 31/03/2023 | From 01/04/2023 | From accounting periods starting on or after 01/04/2024 | From accounting periods starting on or after 01/04/2024 | |

| Profitable company | 130% uplift on costs = 24.7% net benefit | 86% uplift on costs = 21.5% net benefit | Headline rate 13% = 10.5% post tax | Headline rate 20% = post tax rate between 14.7% – 16.2%* | Headline rate 20% = post tax rate between 14.7% – 16.2%* | Not applicable |

| Loss making company | Costs plus 130% uplift = 230 x 14.5% repayable credit = 33.4% subsidy | Costs plus 86% uplift = 186 x 10% repayable credit = 18.6% subsidy | 10.5% subsidy | 15% subsidy | 16.2% subsidy | Not applicable |

| Loss making R&D intensive company | Not applicable | Costs plus 86% uplift = 186 x 14.5% repayable credit = 26.97% subsidy | Not applicable | Not applicable | Not applicable | Costs plus 86% uplift = 186 x 14.5% repayable credit = 26.97% subsidy |

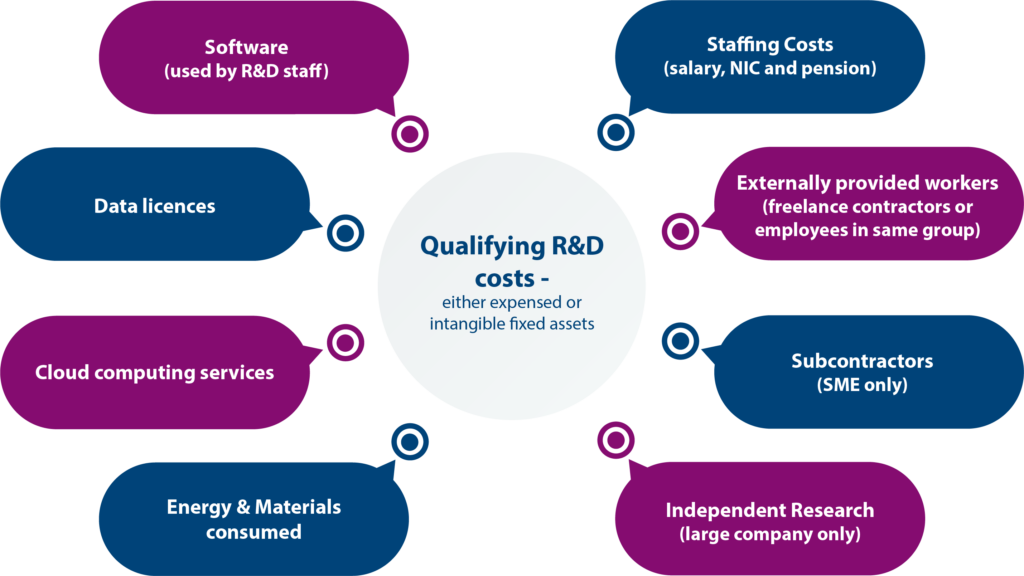

Qualifying costs

So, you think that your company might be doing R&D, but what are the costs that can be included in the claim?

Although the SME and the RDEC regimes are very similar, and they share the same definition of qualifying R&D, the costs which can be included in an R&D claim differ slightly different depending on which regime you fall into, as follows:

Additionally, the definition of R&D for tax reliefs will be expanded to include all mathematics – clarifying in particular that ‘pure maths’ can qualify.

The previously announced restriction on some overseas expenditure will now come into effect from 1 April 2024 instead of 1 April 2023. This will allow the government to consider the interaction between this restriction and the design of a potential merged R&D relief which has been consulted on recently.

For more information, call 020 8037 1030 or complete the form on this page and a member of our R&D team will come back to you.

For more information please follow these links: